Introduction: Why Real Estate Analytics Solutions Matter

In today’s fast-paced real estate market, data is more important than ever. According to a report by McKinsey, data-driven organizations are five times more likely to make decisions faster than their competitors. This statistic highlights the pivotal role that real estate analytics solutions play in driving smarter investment strategies, improving operational efficiency, and enhancing overall decision-making.

When it comes to real estate, having access to accurate, real-time data can be the difference between a successful investment and a costly mistake. In this blog, we’ll delve into the best practices for developing real estate analytics solutions that not only optimize data analysis but also empower stakeholders to make informed, actionable decisions.

By understanding these best practices, businesses can enhance their analytics frameworks, integrate technology efficiently, and ultimately boost their competitive edge. Additionally, we’ll explore how leveraging these solutions can help businesses unlock the full potential of real estate data.

1. Understanding the Foundation of Real Estate Analytics Solutions

Before diving into the best practices, it’s important to understand what real estate analytics solutions entail. These solutions involve collecting, processing, and analyzing data related to the real estate market, including property values, rental income, market trends, and demographic shifts. The goal is to provide actionable insights that guide decision-making in areas such as investment, property management, and sales.

Key elements of real estate analytics solutions include:

- Data Collection: Gathering data from multiple sources like MLS, property records, and real estate platforms.

- Data Processing: Structuring raw data into a usable format, often with the help of AI and machine learning algorithms.

- Visualization: Displaying data through dashboards, graphs, and reports to provide clear insights.

- Reporting: Offering comprehensive reports that allow stakeholders to make decisions based on facts rather than assumptions.

Once the foundation is in place, the next step is to implement best practices that ensure these solutions deliver value.

2. Best Practices for Developing Real Estate Analytics Solutions

To maximize the effectiveness of your real estate analytics solutions, it’s crucial to follow best practices that align with industry standards and business objectives. Below are the top strategies that can guide your development process:

A. Focus on Data Quality and Accuracy

Real estate analytics solutions are only as reliable as the data they’re built on. Ensuring data quality is paramount. This involves:

- Verifying data sources to ensure that you’re using reliable, up-to-date information.

- Cleaning the data by removing duplicates, correcting errors, and handling missing data.

- Standardizing data formats so that it’s easier to analyze and compare across different datasets.

By maintaining high-quality data, you ensure that your insights are both accurate and trustworthy.

B. Use Predictive Analytics for Smarter Decision-Making

Predictive analytics is a game-changer in real estate. It allows stakeholders to forecast future trends, property values, and investment risks. By leveraging machine learning models and historical data, businesses can make informed predictions about:

- Future property values in specific regions.

- Market conditions that may affect investment decisions.

- Potential rental income for properties in different neighborhoods.

Integrating predictive analytics into real estate analytics solutions can provide your team with a forward-looking approach, reducing risk and increasing returns on investment.

C. Implement Advanced Data Visualization Tools

The ability to visualize complex data is crucial for effective decision-making. Dashboards and interactive visualizations help users to quickly grasp insights and identify patterns. These tools should include:

- Real-time dashboards that track key metrics like property prices, market trends, and rental yields.

- Heatmaps to visualize property demand in different areas.

- Graphs and charts that make it easier to compare market trends over time.

By implementing strong data visualization, real estate analytics solutions become more accessible and actionable, helping users interpret insights at a glance.

D. Ensure Mobile Compatibility

In today’s fast-moving world, real estate professionals need to access data on the go. Developing mobile-friendly real estate analytics solutions ensures that your team can access critical information wherever they are. Mobile compatibility offers:

- On-the-go access to data from anywhere, whether on-site or in the office.

- Push notifications for real-time updates on property values and market trends.

- Mobile dashboards that provide a comprehensive overview of the most important metrics.

Mobile accessibility enhances flexibility, enabling stakeholders to make quick decisions based on up-to-date insights.

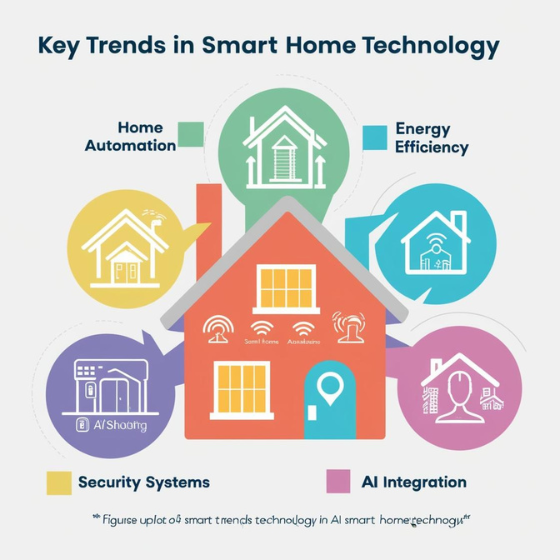

3. Leveraging AI and Machine Learning in Real Estate Analytics

Artificial Intelligence (AI) and machine learning (ML) are transforming the real estate industry. By incorporating these technologies into real estate analytics solutions, businesses can unlock deeper insights and automate decision-making processes. Here’s how AI and ML contribute:

- Automated Valuation Models (AVMs): AI algorithms analyze property data to predict accurate property values, saving time and reducing human error.

- Market Segmentation: ML models analyze buyer behavior, market trends, and economic factors to identify profitable market segments.

- Risk Assessment: AI tools assess risks related to investments by analyzing past market conditions and predicting future downturns.

These technologies empower real estate professionals to make faster, more accurate decisions, leading to higher profitability and reduced risk.

4. The Role of Cloud Technology in Real Estate Analytics Solutions

Cloud technology has revolutionized how real estate data is stored and accessed. By migrating your real estate analytics solutions to the cloud, you can:

- Ensure scalability: Cloud systems can scale with your business, allowing for easy data storage and access as your operations grow.

- Improve collaboration: Teams can access the same data from different locations, making collaboration easier and more efficient.

- Enhance security: Cloud services provide robust security features, including encryption, multi-factor authentication, and regular backups.

The cloud also ensures that your real estate analytics solution is always accessible, ensuring business continuity and providing remote access for real-time decision-making.

5. Case Studies: Real-World Applications of Real Estate Analytics Solutions

To illustrate the impact of real estate analytics solutions, let’s explore a couple of case studies where businesses successfully leveraged data to drive better decisions:

Case Study 1: Predicting Property Value Trends

A leading real estate firm used predictive analytics to forecast property values in different cities. By analyzing factors such as local economic conditions, crime rates, and infrastructure development, they successfully predicted market shifts, enabling them to invest in high-growth areas.

Case Study 2: Optimizing Rental Income

Another firm used data analytics to optimize its rental portfolio. By analyzing historical rent data, demographic trends, and market conditions, they were able to adjust rental pricing in real-time, increasing their revenue by 15%.

These case studies highlight the real-world impact of real estate analytics solutions, showing how data-driven decision-making leads to more successful investments and optimized operations.

Conclusion: Unlock the Power of Data in Real Estate

The potential of real estate analytics solutions is immense, from improving investment strategies to enhancing operational efficiency. By implementing the best practices outlined in this blog, businesses can harness the power of data to drive smarter decisions and better outcomes. As real estate continues to evolve, embracing analytics solutions will be key to staying ahead of the competition.

Ready to get started with real estate analytics solutions for your business? consult with our experts to learn how we can help you develop a customized solution tailored to your needs.

Want to leverage data for better real estate decisions? Contact Sodio’s team today and discover how our advanced analytics solutions can help you gain a competitive edge in the real estate market!