Managing personal finances can be overwhelming. In fact, a 2023 survey revealed that over 60% of people feel stressed about their finances. But what if there was a way to simplify this? Personal finance management apps offer a powerful solution. They help you track expenses, plan for the future, and stay on top of your finances—all in one place.

In this blog, we’ll dive into the key features of personal finance management apps, explore their benefits, and show you how they can help you manage your money more effectively. Whether you’re new to these apps or looking to optimize your usage, this blog will guide you toward financial success.

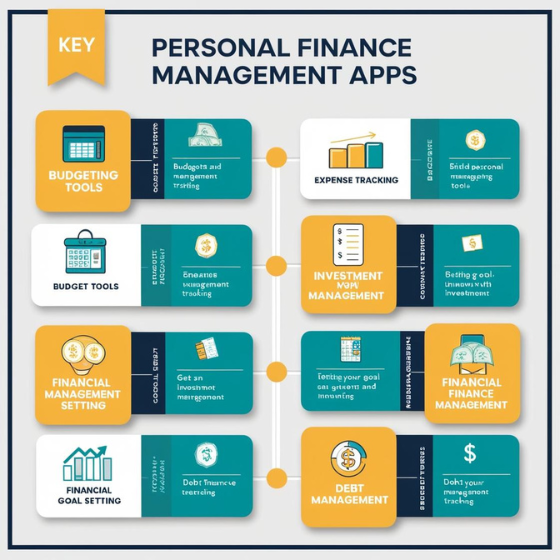

1. Expense Tracking and Categorization

One of the standout features of personal finance management apps is their ability to track expenses. By syncing with your bank accounts and credit cards, these apps automatically monitor your income and spending. This gives you a clear view of where your money is going and helps you spot patterns.

Why It Matters:

- Real-Time Insights: These apps provide live updates on your spending, ensuring you always know where you stand financially.

- Categorization: Expenses are automatically categorized into groups like groceries, entertainment, and bills. This helps you identify where you’re spending too much and adjust accordingly.

Pro Tip: Many apps let you customize categories for a more personalized experience. This helps you focus on the areas that matter most to you.

For businesses looking to build apps with seamless financial tracking, Sodio’s mobile app development services ensure a smooth user experience with real-time syncing and customizable features.

2. Budgeting and Goal Setting

Budgeting is crucial for managing your finances, but it can be difficult to do manually. Many personal finance management apps come with built-in budgeting tools that make the process easier.

Why It Matters:

- Automatic Adjustments: These apps can suggest budget changes based on your spending habits and goals.

- Financial Goals: You can set specific targets, like saving for a vacation or paying off debt. The app tracks your progress and helps you stay on target.

Pro Tip: Create a budget for each category—such as housing, food, and entertainment—and stick to it. Over time, this can help you save more and spend less.

3. Bill Payment Reminders and Automation

Late payments can lead to fees and negatively impact your credit score. Fortunately, many personal finance management apps offer bill payment reminders and automation features.

Why It Matters:

- Timely Alerts: Get notified when a bill is due, so you never miss a payment.

- Automated Payments: Some apps let you set up automatic payments, reducing the chances of forgetting a bill.

If you’re developing a personal finance app, Sodio’s blockchain solutions can help ensure secure, seamless transactions for your users, making bill payments easier than ever.

4. Financial Reports and Insights

The power of data is one of the best features of personal finance apps. These apps can generate detailed reports that break down your finances, helping you make informed decisions.

Why It Matters:

- Visuals: With charts and graphs, these apps make complex data easy to understand.

- Tax-Friendly Reports: For those with unique financial situations, these apps can generate reports that simplify tax filing.

When developing an app, Sodio’s UI/UX design services focus on creating user-friendly interfaces that present data in a way that is easy for anyone to understand.

5. Security and Privacy Features

When it comes to financial information, security is non-negotiable. Many personal finance management apps provide robust security measures to keep your data safe.

Why It Matters:

- Encryption: Apps use encryption to protect your financial data.

- Two-Factor Authentication (2FA): Many apps offer 2FA to prevent unauthorized access.

- Privacy Policies: Trustworthy apps provide transparency about how your data is used and protect it with strong privacy policies.

Sodio’s IT services can help integrate the latest security features into your app, ensuring user data remains protected at all times.

6. Investment Tracking and Management

Personal finance apps are not just for managing daily expenses—they also help you track and manage investments. These key features of personal finance management apps include tools that help users monitor their portfolios and analyze their returns.

Why It Matters:

- Real-Time Data: Stay updated on the latest market trends with live market data.

- Portfolio Management: Many apps help you diversify your investments, reducing risk and increasing potential returns.

With the right features, users can manage their investments alongside their daily finances, making it easier to achieve long-term financial goals.

Why You Should Use Personal Finance Management Apps

Personal finance apps offer a range of key features that can help you take control of your financial life. From tracking expenses to managing investments, these apps offer all the tools you need to stay on top of your finances and reach your goals.

At Sodio, we specialize in creating custom apps that integrate these features seamlessly. If you’re looking to build a finance app or improve an existing one, our team can help you design a solution that meets the needs of today’s digital users.

Explore Sodio’s mobile app development services to build a personalized personal finance app. Our experts will guide you through every step of the development process to ensure you’re creating an app that offers value and security to users.

Conclusion

The key features of personal finance management apps are crucial for anyone looking to manage their money more effectively. These apps help users track spending, set goals, automate payments, and analyze their financial health—all in one place.

If you want to create or improve your own finance app, Sodio can help you integrate the latest features and security measures. Get in touch with us today to start building a solution that helps users take control of their financial future.