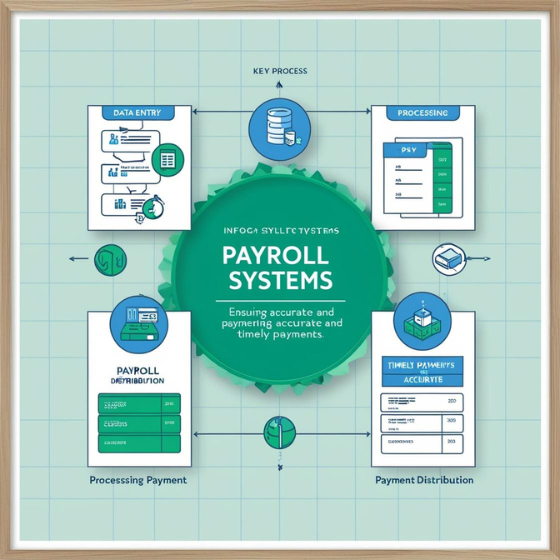

Key Trends in Payroll System Development

As businesses evolve and technology continues to advance, so too does the way companies handle payroll. In today’s fast-paced environment, payroll system development plays a crucial role in ensuring businesses are not only compliant with tax laws but also efficient, cost-effective, and aligned with employee expectations. From automation to mobile access, modern payroll systems are designed to simplify complex processes and improve both employer and employee experiences.

In this blog, we will explore the key trends in payroll system development, highlighting innovations and shifts that are reshaping how businesses manage payroll. By understanding these trends, you can ensure that your payroll system remains up-to-date, secure, and optimized for both efficiency and employee satisfaction.

1. Automation and Artificial Intelligence (AI)

One of the most significant trends in payroll system development is the integration of automation and AI technologies. These technologies help streamline manual payroll tasks, reducing the risk of errors, enhancing accuracy, and saving valuable time for HR and finance teams.

Key Benefits of Automation and AI:

- Error Reduction: Automated systems reduce the likelihood of human errors, such as incorrect tax calculations or missed deductions.

- Efficiency: Automation speeds up payroll processing, allowing for timely payments without delays.

- Cost Savings: By automating routine tasks, businesses can free up resources and reduce administrative costs.

- AI-Powered Insights: AI can analyze payroll data to identify trends, predict future payroll needs, and optimize processes for better decision-making.

Examples of AI in Payroll:

- Predictive Analytics: AI can predict payroll issues such as overpayments or underpayments, helping businesses address problems before they occur.

- Chatbots: AI-driven chatbots can assist employees in accessing payroll information, reducing the need for manual queries.

As AI continues to advance, expect payroll systems to become even more intuitive, automated, and proactive.

2. Mobile-Friendly Payroll Systems

The rise of mobile technology has significantly influenced payroll system development. Today, employees expect to have access to their payroll information anytime, anywhere. Mobile-friendly payroll systems allow employees to check pay stubs, manage their benefits, and even request time off directly from their smartphones.

Benefits of Mobile Payroll Systems:

- Convenience: Employees can access payroll information from their smartphones or tablets, providing them with greater flexibility.

- Real-Time Updates: Mobile access ensures that employees can receive immediate updates on their payroll status or any changes made to their accounts.

- Employee Engagement: A mobile-friendly payroll system allows employees to take an active role in managing their pay, improving overall engagement.

By offering mobile payroll solutions, companies can enhance employee satisfaction and improve the efficiency of payroll processing.

3. Integration with Other Business Systems

Another growing trend in payroll system development is the integration of payroll with other core business systems, such as Human Resources Management Systems (HRMS), Time and Attendance Systems, and Accounting Software. This integration ensures a seamless flow of data across various departments, reducing duplication of efforts and improving accuracy.

Key Benefits of System Integration:

- Accuracy: Automated data transfer between payroll and HR systems ensures that employee information, such as hours worked and benefits, is up-to-date and accurate.

- Streamlined Processes: Integration minimizes the need for manual data entry, reducing the chances of errors and saving time.

- Comprehensive Reporting: Integrated systems allow for better data analysis and reporting, providing managers with valuable insights into labor costs, payroll trends, and more.

Companies are increasingly adopting cloud-based solutions that integrate payroll with other business functions, creating a unified system that enhances productivity and decision-making.

4. Cloud-Based Payroll Solutions

Cloud computing has revolutionized the way businesses operate, and payroll is no exception. Cloud-based payroll systems allow businesses to process payroll from anywhere, at any time, as long as there is internet access. This trend is especially beneficial for businesses with remote teams or multiple locations.

Benefits of Cloud-Based Payroll Systems:

- Accessibility: Cloud systems provide remote access to payroll data, making it easy for HR teams to process payroll even from different locations.

- Scalability: Cloud-based payroll systems can scale with the growth of your business, accommodating more employees without the need for significant infrastructure upgrades.

- Security: Cloud providers offer robust security features, including encryption and regular backups, to protect sensitive payroll data.

- Cost-Effective: Cloud-based solutions typically have lower upfront costs and are often offered on a subscription basis, making them a more affordable option for small to mid-sized businesses.

By adopting cloud-based payroll solutions, businesses can benefit from increased flexibility, reduced IT costs, and improved collaboration across departments.

5. Enhanced Data Security and Compliance

As data privacy and security concerns continue to grow, payroll system developers are placing a strong emphasis on data security and regulatory compliance. Payroll systems handle sensitive employee information, such as salaries, tax details, and banking information, making them a prime target for cyberattacks.

Key Security Features in Modern Payroll Systems:

- Encryption: Payroll systems now encrypt sensitive data during both storage and transmission to prevent unauthorized access.

- Multi-Factor Authentication (MFA): To further protect payroll data, many systems now require multiple forms of authentication before granting access.

- Compliance Tracking: Payroll systems automatically update to ensure they comply with the latest local, state, and federal regulations, including tax laws and labor rights.

Staying compliant with tax laws and maintaining data security is essential for avoiding penalties and maintaining trust with employees. Payroll systems now come with features that automatically calculate and report tax withholdings, ensuring businesses remain in compliance with changing regulations.

6. Employee Self-Service Portals

Another significant trend is the growing popularity of employee self-service portals. These portals allow employees to view and manage their own payroll information, including pay stubs, tax forms, and personal details, without needing to contact HR or payroll departments.

Benefits of Employee Self-Service Portals:

- Empowerment: Employees can take control of their payroll data, making updates, viewing pay history, and requesting benefits directly through the portal.

- Reduced HR Workload: By giving employees the ability to manage their own information, HR departments can focus on more strategic tasks.

- Transparency: Employees gain visibility into their payroll details, increasing trust in the payroll process and reducing inquiries to HR.

Self-service portals also foster a more engaged and informed workforce, empowering employees to track and manage their compensation and benefits.

7. Blockchain for Payroll Security

Although still in the early stages, blockchain technology is beginning to make its way into payroll systems. Blockchain’s decentralized nature and its ability to provide transparent, immutable records offer enhanced security and efficiency for payroll processes.

Benefits of Blockchain in Payroll:

- Transparency: Blockchain ensures transparency in payroll transactions, providing an immutable record of every payment made.

- Security: With blockchain, the risk of fraud and unauthorized access to payroll data is reduced due to its secure, decentralized nature.

- Speed: Blockchain enables faster payment processing by cutting out intermediaries, allowing employees to receive payments instantly or near-instantly.

While still emerging, blockchain has the potential to revolutionize payroll by offering unprecedented security and transparency.

Conclusion: The Future of Payroll System Development

The payroll system development landscape is rapidly evolving, driven by technological advancements such as automation, cloud computing, and AI. As businesses continue to prioritize efficiency, security, and employee satisfaction, adopting these key trends in payroll systems can ensure that your organization remains competitive, compliant, and future-ready.

Whether you’re considering implementing a new payroll system or upgrading your current one, staying ahead of these trends will help you manage payroll more effectively and provide a better experience for both your HR team and employees. Embrace the future of payroll with innovative, secure, and efficient solutions designed to meet the needs of a modern workforce.

For more information on how to optimize your payroll systems, contact Sodio today and explore our tailored payroll solutions designed to enhance efficiency and accuracy in your business operations.