Mobile Banking Apps: Enhancing Customer Experience

Mobile banking apps have revolutionized how we manage finances, providing customers with unparalleled convenience, security, and efficiency. In fact, over 76% of consumers now prefer banking through mobile apps over traditional methods, making these platforms a crucial element in modern financial services. This blog explores how mobile banking apps enhance customer experience by integrating cutting-edge features, fostering trust, and offering personalized solutions.

Why Mobile Banking Apps Are Transforming Financial Services

The global mobile banking market is expected to grow to $1.82 billion by 2026, driven by increasing smartphone penetration and demand for secure digital banking solutions. Customers expect more than just basic banking features—they want apps that simplify complex financial tasks, provide real-time assistance, and safeguard their data.

This blog will guide you through:

- The role of mobile banking apps in improving customer satisfaction

- Essential features for optimizing the mobile banking experience

- Case studies of banks excelling in customer-centric app design

- How Sodio helps financial institutions develop transformative mobile banking solutions

1. Personalization: The Heart of Customer Experience

Modern customers expect tailored experiences that resonate with their financial needs. Personalized features in mobile banking apps not only build trust but also foster long-term loyalty.

Key Features Enhancing Personalization:

- AI-Powered Insights: Recommend saving plans, investment options, or expense management tips based on spending patterns.

- Customizable Dashboards: Allow users to prioritize frequently used features like fund transfers or transaction history.

- Localized Content: Support regional languages, currency preferences, and region-specific offers.

? Explore Sodio’s AI-driven app development services here.

2. Seamless Navigation and Intuitive Design

No one wants to spend hours figuring out how to transfer money or check their balance. A well-designed interface improves usability and ensures customer satisfaction.

Best Practices for App Design:

- Simple Navigation: Organize features into logical categories like Payments, Savings, and Loans.

- Interactive Tutorials: Guide users through first-time setups or complex transactions.

- Accessibility Features: Incorporate text-to-speech, large fonts, and color contrast options to serve all users.

? Example: Capital One’s app integrates a voice assistant to help users navigate tasks effortlessly.

? Learn about Sodio’s UI/UX services for mobile banking apps here.

3. Security: Building Customer Trust

Security breaches can severely damage customer trust. Mobile banking apps must prioritize robust security measures to protect sensitive data and transactions.

Essential Security Features:

- Multi-Factor Authentication (MFA): Combine passwords with biometric verification for heightened security.

- End-to-End Encryption: Protect data from unauthorized access during transmission.

- Real-Time Fraud Alerts: Notify users of suspicious activities instantly.

? See how Sodio implements advanced security in app development here.

4. Real-Time Features: The Need for Speed

Today’s customers demand instant updates and seamless services. Mobile banking apps equipped with real-time features deliver an unmatched experience.

Must-Have Real-Time Capabilities:

- Instant Transfers: Enable immediate money transfers across accounts.

- Real-Time Notifications: Inform users about account activity, due payments, or special offers.

- Live Customer Support: Integrate chatbots or live chat features for 24/7 assistance.

? Case Study: A leading FinTech company partnered with Sodio to integrate real-time analytics into their banking app, reducing transaction wait times by 40%.

? Read the full case study here.

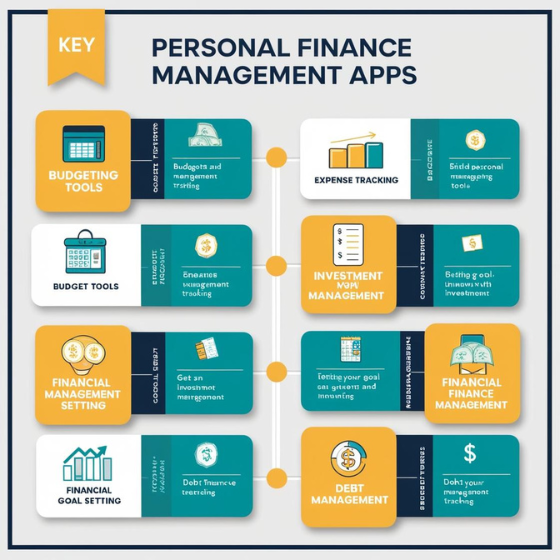

5. Integrated Financial Ecosystems

Customers appreciate all-in-one platforms that simplify their financial lives. Apps that integrate multiple services within a single platform significantly enhance user convenience.

Integrated Features to Consider:

- Budgeting Tools: Help users track expenses and create savings goals.

- Investment Platforms: Offer options for stock trading, mutual funds, or cryptocurrency investments.

- Loan Calculators: Simplify loan application processes by offering instant EMI calculations.

Conclusion

Mobile banking apps have transformed the financial landscape, offering customers a seamless and secure way to manage their finances. By focusing on personalization, intuitive design, robust security, and real-time features, financial institutions can elevate customer satisfaction and stay ahead in a competitive market.

At Sodio, we specialize in creating mobile banking apps that enhance customer experience through innovative features and user-centric design. Whether you’re building a new app or upgrading an existing platform, our team is here to bring your vision to life.

Ready to Redefine Banking?

? Contact Sodio for a consultation today!

? Explore our mobile app development services here.