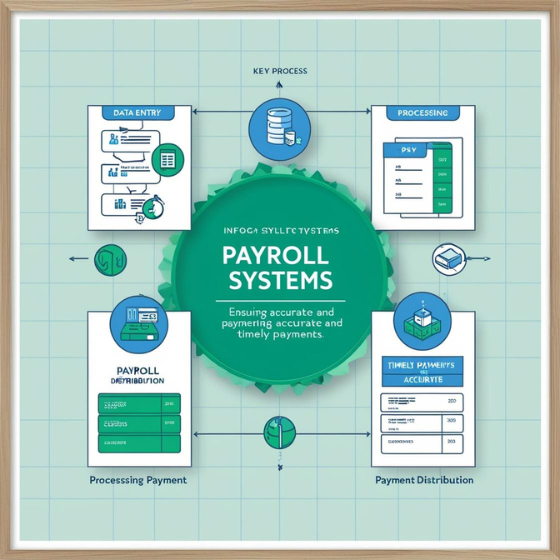

Payroll Systems: Ensuring Accurate and Timely Payments

Payroll is one of the most crucial aspects of any business operation. Ensuring that employees are paid accurately and on time not only supports employee satisfaction but also helps maintain trust and compliance within the organization. Payroll systems: ensuring accurate and timely payments are essential for businesses of all sizes, helping streamline payroll processes, reduce human error, and improve efficiency.

In this blog, we’ll explore why payroll systems are important, the key features to look for, and best practices for ensuring timely and accurate payments. By understanding these critical components, you can improve your payroll operations and focus on growing your business.

Why Payroll Systems Matter

Managing payroll manually can be time-consuming and error-prone, especially as a business grows. Payroll errors, whether due to miscalculations, missed deductions, or delayed payments, can lead to dissatisfied employees, legal penalties, and even damage to the company’s reputation.

Key Benefits of Payroll Systems:

- Accuracy: Automated calculations reduce the chances of payroll errors.

- Timeliness: Employees receive payments on time, leading to increased satisfaction and trust.

- Compliance: Payroll systems help ensure your company remains compliant with local, state, and federal regulations.

- Efficiency: Automating payroll processes saves time, allowing HR teams to focus on other important tasks.

By using an effective payroll system, businesses can ensure that payroll is handled with precision and efficiency, avoiding the pitfalls that come with manual systems.

Key Features of an Effective Payroll System

When selecting a payroll system for your business, it’s important to choose one with the right features that meet your specific needs. Below are some of the most important features to look for in a payroll solution:

1. Automated Calculations

Payroll systems should automatically calculate salaries, wages, deductions, and taxes based on the data entered. This eliminates the risk of manual errors and ensures that employees are paid the correct amount every time.

Key Features:

- Automatic deductions for taxes, benefits, and other withholdings.

- Accurate tracking of overtime and holiday pay.

- Customizable settings for different pay structures (e.g., hourly, salaried, commission-based).

2. Direct Deposit Capabilities

Offering direct deposit allows employees to receive their paychecks electronically, eliminating the need for paper checks and making the payment process faster and more secure.

Key Features:

- Supports multiple bank accounts for employee payments.

- Allows automatic distribution across different accounts.

- Instant payment processing for improved cash flow management.

3. Tax Compliance and Reporting

Payroll systems should help businesses stay compliant with changing tax laws and filing deadlines. These systems automatically calculate federal, state, and local taxes and generate reports for easy filing.

Key Features:

- Automated tax calculation for federal, state, and local requirements.

- Generates W-2s, 1099s, and other necessary tax forms.

- Real-time tax updates to keep the business compliant.

4. Time and Attendance Tracking

Accurately tracking employee hours, especially for hourly employees, is crucial for payroll accuracy. Time and attendance systems that integrate directly with payroll can help prevent over- or underpayment.

Key Features:

- Integration with biometric or digital time clocks.

- Self-service portals for employees to track their own hours.

- Integration with HR and payroll systems to ensure accurate payments.

5. Payroll Reporting and Analytics

Having access to detailed reports and analytics on payroll is essential for managers to track labor costs, ensure accuracy, and identify trends.

Key Features:

- Customizable reports on payroll expenditures, employee earnings, and tax withholdings.

- Year-end reports for tax preparation and auditing.

- Real-time access to payroll data for HR and accounting teams.

6. Employee Self-Service Portal

A self-service portal allows employees to access their pay stubs, tax forms, and benefits information, reducing HR’s administrative workload.

Key Features:

- Employees can view and download pay stubs and tax forms (W-2, 1099).

- Self-update personal information like address or bank account details.

- Submit timesheets, vacation requests, or other payroll-related requests.

7. Security Features

Payroll data is sensitive, and businesses need to ensure the security of both employee information and financial records.

Key Features:

- Encryption of payroll data during transmission and storage.

- Role-based access controls to restrict sensitive data access.

- Regular backups to prevent data loss.

Best Practices for Ensuring Timely and Accurate Payroll

Now that we’ve covered key features of payroll systems, it’s important to establish best practices that ensure your payroll system delivers timely and accurate payments every time.

1. Regularly Update Employee Information

Payroll systems rely on up-to-date employee information to process accurate payments. Make sure that HR consistently updates employee records, including tax status, direct deposit information, and benefit elections.

Tip:

Conduct periodic audits of employee records to ensure accuracy and compliance.

2. Automate Payroll Processes

Automation is a critical aspect of payroll accuracy and efficiency. Ensure that your payroll system is set up to automatically calculate wages, taxes, and deductions based on employee data.

Tip:

Set up automated reminders for payroll deadlines and tax filing dates to ensure timely execution.

3. Maintain a Clear Payroll Schedule

Establishing and maintaining a consistent payroll schedule helps both employees and HR teams plan effectively. Whether your organization pays weekly, bi-weekly, or monthly, consistency is key.

Tip:

Communicate the payroll schedule clearly to employees and keep them informed of any changes.

4. Ensure Tax Compliance

Tax laws change frequently, and staying compliant can be a challenge. Payroll systems that automatically update tax rates and filing requirements help ensure that your company stays on top of its tax obligations.

Tip:

Work with a payroll provider or tax expert to review your system’s compliance on a regular basis.

5. Monitor Payroll Reports

Regularly review payroll reports to monitor discrepancies, trends, and errors that may affect payments or compliance. Consistent reporting ensures that any issues are caught and addressed early.

Tip:

Conduct quarterly audits to ensure the accuracy of payroll records and identify any potential issues before they escalate.

6. Provide Ongoing Training

Ensure that the HR and payroll teams are properly trained in the use of the payroll system. Regular training helps avoid mistakes and ensures the smooth running of payroll cycles.

Tip:

Offer refresher courses and updates on system changes to keep the team informed of new features or updates.

How Sodio Can Help with Payroll Solutions

At Sodio, we specialize in developing customized payroll solutions that ensure accurate, timely payments and compliance with tax laws. Whether you’re looking to automate payroll processing, track time and attendance, or generate detailed reports, our solutions are designed to meet the unique needs of your business.

What We Offer:

- Custom Payroll Solutions: Tailored to your business size and structure.

- Integration with HR Systems: Seamlessly integrate payroll with other HR functions for a unified approach.

- Comprehensive Reporting and Analytics: Easily access payroll data and insights to make informed decisions.

Ready to Simplify Payroll?

Contact us today to discover how we can help streamline your payroll processes and ensure accurate, timely payments for your team.

Conclusion: The Importance of Payroll Systems

Payroll systems are the backbone of any successful business, ensuring that employees are paid accurately and on time. By adopting a reliable payroll solution and following best practices, you can reduce administrative overhead, improve employee satisfaction, and maintain compliance with tax regulations.

Whether you’re upgrading your existing payroll system or starting from scratch, investing in the right solution is key to supporting your team and fueling your business’s growth. Get in touch with Sodio to learn more about how we can help you optimize your payroll processes.