Introduction: The Power of Data in Real Estate

Did you know that 90% of real estate companies believe data analytics is crucial to gaining a competitive edge? In today’s data-driven world, real estate analytics is no longer optional; it’s a necessity. From identifying lucrative investments to understanding customer behavior, data empowers businesses to make informed decisions.

This blog explores how real estate analytics is transforming the industry and how leveraging data can lead to smarter, more profitable choices. Whether you’re an investor, developer, or agent, understanding the role of analytics can redefine your approach to real estate.

1. What is Real Estate Analytics?

Real estate analytics involves collecting, processing, and interpreting data to gain actionable insights. These insights help stakeholders in real estate make informed decisions about investments, operations, and customer management.

Key Components of Real Estate Analytics:

- Market Trends Analysis: Understanding supply, demand, and pricing fluctuations.

- Customer Insights: Analyzing buyer preferences, demographics, and behavior.

- Operational Efficiency: Using data to optimize property management and reduce costs.

- Investment Risk Assessment: Identifying potential risks before committing to a property.

By leveraging real estate analytics, companies can predict trends, reduce risks, and capitalize on emerging opportunities.

2. The Benefits of Leveraging Data in Real Estate

a) Enhanced Decision-Making

Data provides clarity and direction, enabling professionals to make decisions backed by evidence rather than intuition. For example, an investor can analyze neighborhood growth trends to identify high-potential areas for development.

b) Improved Customer Experience

Understanding customer needs is critical in real estate. Analytics enables businesses to tailor their offerings, ensuring better satisfaction and retention rates.

c) Efficient Resource Allocation

Data helps identify where resources should be concentrated, whether it’s marketing budgets, operational improvements, or property enhancements.

d) Risk Mitigation

Predictive analytics can identify potential risks, such as market downturns or unprofitable investments, giving stakeholders a chance to act proactively.

e) Increased Profitability

Optimizing property pricing, predicting market trends, and reducing operational inefficiencies all contribute to higher profitability.

3. How Real Estate Analytics Works

Step 1: Data Collection

Real estate data is gathered from various sources, including:

- Market reports

- Customer feedback

- Social media trends

- Online property listings

- IoT devices in smart buildings

Step 2: Data Processing

The collected data is cleaned, organized, and analyzed using tools like predictive modeling, machine learning, and AI algorithms.

Step 3: Insights and Action

Actionable insights are derived, such as:

- Identifying undervalued properties.

- Predicting future rental income.

- Understanding customer pain points to enhance services.

For example, companies like Sodio leverage advanced analytics to help clients make data-backed decisions, ensuring maximum ROI.

4. Real-World Applications of Real Estate Analytics

a) Predicting Market Trends

Advanced analytics tools can forecast future demand for properties in specific areas, helping developers plan projects strategically.

Case Study:

A real estate firm used historical data and predictive models to identify upcoming hotspots in suburban areas. Their timely investments yielded a 30% increase in returns compared to urban areas with saturated markets.

b) Optimizing Property Pricing

Analytics ensures that properties are neither underpriced nor overpriced by evaluating market conditions, property features, and competitor pricing.

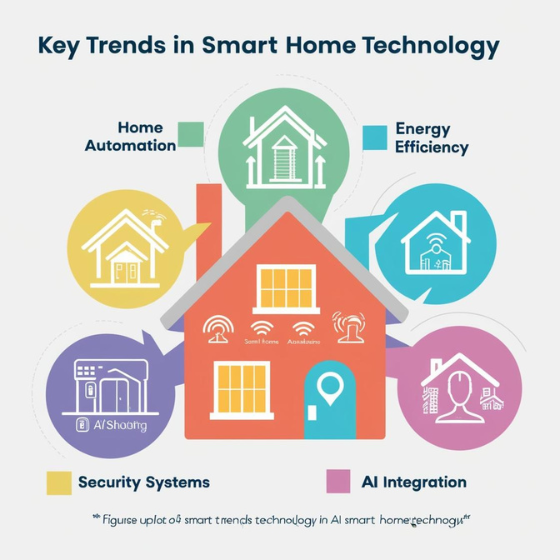

c) Enhancing Property Management

Data helps streamline operations such as maintenance schedules, energy consumption, and tenant communication. For instance, IoT devices in smart buildings collect real-time data, enabling predictive maintenance and reducing costs.

d) Tailored Marketing Campaigns

By analyzing customer preferences and search behavior, companies can create targeted marketing campaigns, improving lead generation and conversion rates.

e) Sustainable Development

Environmental impact assessments and energy usage analytics guide the development of eco-friendly properties, meeting customer demand for sustainable living.

5. Tools and Technologies for Real Estate Analytics

The real estate industry relies on a variety of tools to gather and interpret data.

Popular Analytics Tools:

- Tableau: For interactive data visualization.

- Power BI: A business intelligence tool to analyze and visualize data.

- Zoho Analytics: For detailed real estate reporting and insights.

- Sodio’s Custom Solutions: Offering tailored analytics platforms for real estate businesses.

Emerging Technologies in Real Estate Analytics:

- AI and Machine Learning: Enhances predictive analytics and trend forecasting.

- Blockchain: Improves transparency in property transactions.

- IoT (Internet of Things): Collects real-time data from smart devices.

- GIS Mapping: Provides spatial analysis for location-based decision-making.

Companies investing in these technologies gain a significant competitive edge.

6. Challenges in Implementing Real Estate Analytics

While the benefits are immense, adopting analytics in real estate comes with challenges:

- Data Privacy Concerns: Ensuring customer data is secure and compliant with regulations.

- Integration Issues: Combining legacy systems with modern analytics platforms can be complex.

- Skill Gaps: Many real estate professionals lack the technical expertise to interpret data.

Solution:

Collaborate with experts like Sodio, who specialize in developing custom analytics solutions for the real estate sector, ensuring seamless integration and maximum value.

Conclusion: Why Real Estate Analytics is the Future

In an industry as dynamic as real estate, relying on intuition is no longer sufficient. Real estate analytics is revolutionizing the way professionals approach investments, operations, and customer engagement.

By leveraging data, businesses can:

- Stay ahead of market trends.

- Mitigate risks effectively.

- Enhance profitability and customer satisfaction.

Ready to unlock the potential of real estate analytics for your business? Our cutting-edge tools and expert guidance can help you make data-driven decisions that drive success. Contact us now for a consultation!